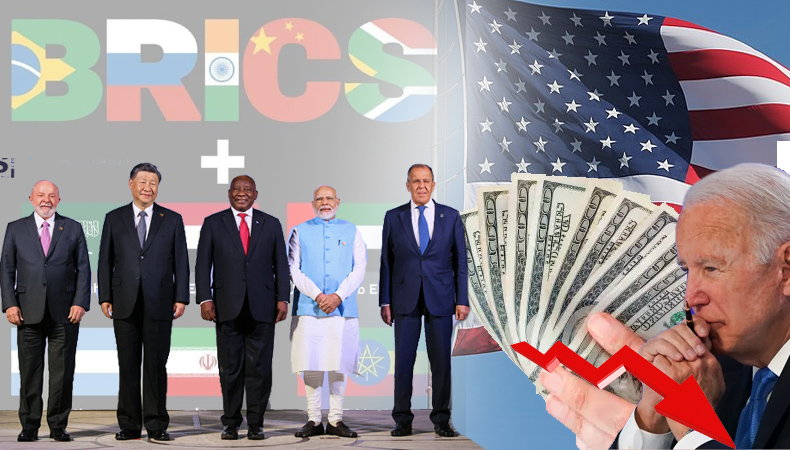

Multipolar World: BRICS and the Diminishing Dollar Dominance

In an increasingly interconnected and globalized world, geopolitical power dynamics are undergoing a significant transformation. The emergence of a multipolar world, marked by the rise of regional blocs such as BRICS (Brazil, Russia, India, China, and South Africa), is heralding a new era in which the dollar’s dominance and the United States’ financial hegemony are being challenged.

This shift is compelling countries in Latin America, Asia, and the Middle East to reassess their economic and geopolitical strategies. The global power landscape is no longer a unilateral terrain dominated solely by the United States. As the BRICS bloc and other emerging economies strengthen their economic prowess, they are collectively contributing to a more balanced distribution of power. These nations are forging partnerships based on mutual interests, diversifying their alliances, and exploring alternatives to the dollar-centric global financial system.

Catalyst of Change

BRICS has emerged as a prime example of how countries can collaborate to promote their interests in a multipolar world. By forming this bloc, Brazil, Russia, India, China, and South Africa are pooling their resources, expertise, and influence to create a counterbalance to Western dominance. Through initiatives like the New Development Bank (NDB), which provides funding for infrastructure and sustainable development projects, BRICS nations are cultivating economic independence and reducing their reliance on Western financial institutions.

Keep Reading

The decline of the dollar’s supremacy is evident in the efforts of numerous countries to diversify their reserves and trade arrangements. Governments in Latin America, Asia, and the Middle East are proactively seeking ways to reduce their vulnerability to potential economic shocks originating from the United States.

Looking for Alternatives

Countries in this region, traditionally under the influence of U.S. economic policies, are pivoting towards alternatives. Venezuela, for example, has turned to cryptocurrencies like Petro to circumvent U.S. sanctions. Argentina and Brazil are exploring currency swaps with China to enhance their economic stability.

In Asia, the establishment of the China-led Asian Infrastructure Investment Bank (AIIB) is a clear signal of a multipolar financial landscape. Iran, facing U.S. sanctions, is engaging in barter trade agreements to sidestep dollar transactions. Additionally, countries like India are fostering stronger economic ties with Russia and China through various initiatives, diminishing the dollar’s hold.

The Middle East is witnessing a shift as well. The United Arab Emirates and Saudi Arabia are diversifying their sovereign wealth funds away from dollar-based assets. Iran and Turkey are strengthening economic collaboration with Russia and China, embracing alternative currencies for trade settlement.

A New World Order

As the multipolar world continues to evolve, nations are actively recalibrating their economic strategies to ensure resilience and autonomy. The rise of BRICS and the diminishing dominance of the dollar signal a paradigm shift that requires countries to be more flexible and adaptive in their approaches.

While the United States remains an influential player, the emergence of new power centers and regional blocs underscores the need for cooperation, mutual respect, and diplomacy to navigate this evolving global order. In this transitional phase, embracing financial diversification, exploring alternative trade mechanisms, and fostering partnerships will be paramount for countries seeking to thrive in the emerging multipolar world.

The road ahead may be challenging, but it is an opportunity for nations to collectively shape a more equitable and balanced global economic landscape.